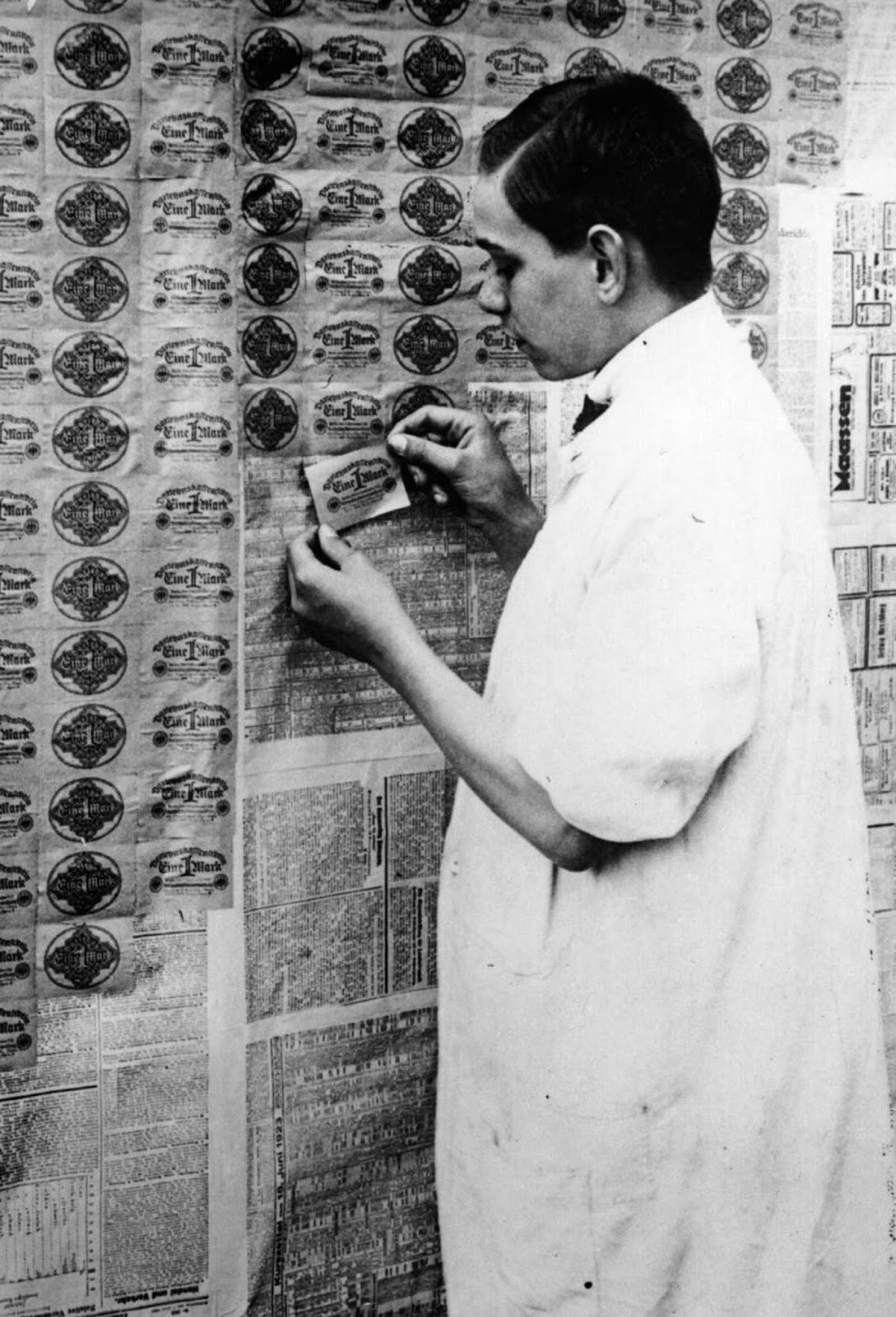

Using banknotes as wallpaper during German hyperinflation, 1923

Germany was a prosperous country before World War I, with a gold-backed currency, expanding industry, and world leadership in optics, chemicals, and machinery. The German mark, British shilling, French franc, and Italian lira all had roughly the same value, and were all exchanged for four or five dollars. That was in 1914.

In 1923, at the most tumultuous moment of German hyperinflation, the exchange rate between the dollar and the mark was one trillion marks to one dollar, and a wheelbarrow full of money wouldn't even buy a newspaper. Most Germans were surprised by the financial whirlwind. The meaning of currency was lost.

Hyperinflation in the Weimar Republic in Germany (Weimar Republic) between June 1921 and January 1924 was a three-year period of hyperinflation. Starting in August 1921, Germany began buying foreign currency with the marks at any price, but this only increased the speed of the break in the mark's value.

The lower the points dipped in the international markets, the higher the amount needed to buy the foreign exchange demanded by the revaluation commission.

During the first half of 1922, the mark stabilized at around 320 marx per dollar. This was also accompanied by the International Indemnity Convention, which was held in June 1922 by the American investment banker J.P. Morgan, Jr., a conference was also included.

When these meetings did not yield any practical solution, inflation turned into hyperinflation and by December 1922 the mark had fallen to 800 marks per dollar. The cost-of-living index was 41 in June 1922 and 685 in December, an increase of more than 15 times. ,

No comments: